Introduction

The term “business inventories increase” may sound mundane, but it carries significant weight in the realm of economics and finance. An increase in business inventories can serve as a barometer for economic health, corporate expectations, and supply chain dynamics. In this comprehensive article, we will delve into what business inventories are, why they increase, the sectors most affected, and the broader implications for the economy. Additionally, we will explore how policymakers, investors, and businesses interpret and respond to changes in inventory levels.

What Are Business Inventories?

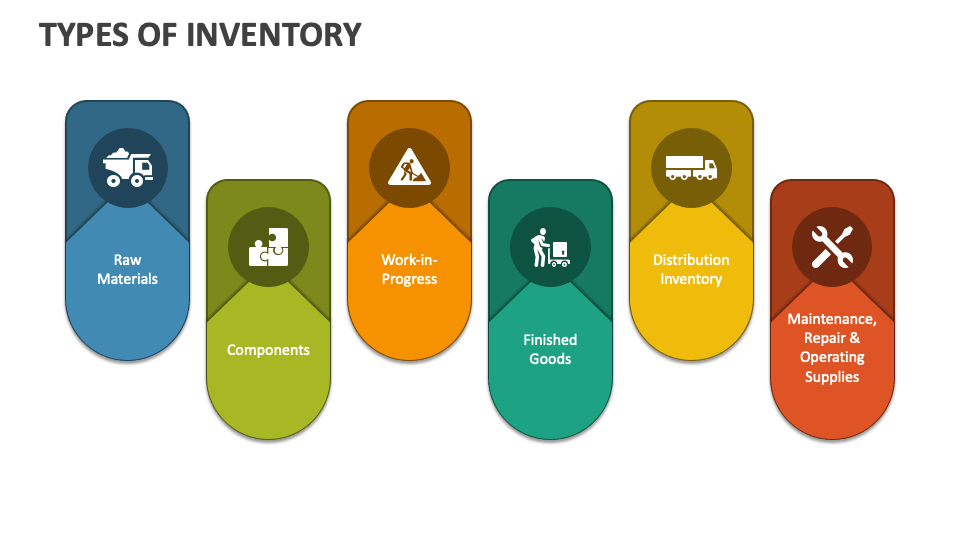

Business inventories refer to the goods and materials that companies keep in stock to support production and sales. These can be raw materials, work-in-progress items, or finished goods awaiting sale. Business inventories are reported as part of the national economic statistics and are crucial indicators of future production and consumption trends.

The U.S. Census Bureau, for instance, provides monthly reports on business inventories that include data from manufacturers, wholesalers, and retailers. These figures help paint a picture of supply and demand dynamics in the economy.

Reasons for an Increase in Business Inventories

- Anticipation of Higher Demand: Businesses often build up inventory in anticipation of increased consumer demand, particularly during holiday seasons or new product launches.

- Supply Chain Disruptions: Companies may stockpile inventory to mitigate risks from potential supply chain disruptions. This was particularly evident during the COVID-19 pandemic when global supply chains were severely affected.

- Economic Uncertainty: During uncertain economic periods, businesses might increase inventory to hedge against potential shortages or price hikes.

- Production Lag: Sometimes, production outpaces sales, leading to an unintended build-up of inventory. This can occur due to overestimation of demand or delays in marketing.

- Changes in Inventory Management: Technological advancements or shifts in logistics strategies can lead businesses to alter their inventory levels.

Sectors Most Affected by Inventory Changes

- Retail: Retail businesses are highly sensitive to inventory changes. Overstocking can lead to discounting and lower profit margins, while understocking may result in lost sales.

- Manufacturing: Inventory levels in manufacturing indicate future production needs. High inventories can signal reduced future production, while low inventories may lead to increased manufacturing activity.

- Wholesale: Wholesalers act as intermediaries between manufacturers and retailers. Their inventory levels provide insights into upcoming trends in retail and manufacturing.

Economic Indicators Related to Inventories

- Inventory-to-Sales Ratio: This ratio measures the relationship between inventories and sales. A rising ratio may suggest weakening demand or excess supply.

- Gross Domestic Product (GDP): Inventory levels affect GDP calculations. An increase in inventories contributes positively to GDP, while a drawdown reduces it.

- Purchasing Managers’ Index (PMI): This index includes data on inventory levels and is closely watched by economists and investors.

Implications of Increasing Inventories

- Positive Indicators:

- Signals business confidence in future demand.

- Suggests readiness for upcoming consumer demand spikes.

- Negative Indicators:

- May indicate overproduction or overestimation of demand.

- Leads to increased holding costs and potential markdowns.

- Mixed Signals:

- Sometimes, inventory increases are strategic, not necessarily reflective of market weaknesses.

Policy Responses and Strategic Business Actions

- Monetary Policy: Central banks may interpret rising inventories as a sign of slowing demand and adjust interest rates accordingly.

- Fiscal Policy: Governments might introduce stimulus measures to boost consumer demand if inventories rise due to weak sales.

- Corporate Strategy:

- Enhance demand forecasting models.

- Invest in just-in-time inventory systems.

- Diversify supply chains to mitigate risk.

Case Studies

- COVID-19 Pandemic: During the pandemic, many companies increased inventories to deal with uncertainties in supply and demand.

- Retail Industry: Major retailers like Walmart and Target have experienced inventory fluctuations that affected stock prices and profitability.

- Technology Sector: Tech firms often face rapid product obsolescence, making inventory management critical.

Investor Perspective

- Stock Valuation: High inventory levels can affect earnings and stock prices.

- Earnings Reports: Investors scrutinize inventory levels during earnings calls to gauge future performance.

- Market Sentiment: Inventory data influences market sentiment and investment decisions.

Global Perspective

- International Trade: Global inventory levels affect trade balances and shipping costs.

- Emerging Markets: Developing economies with less advanced logistics may face greater challenges in inventory management.

- Geopolitical Risks: Political instability and trade wars can prompt companies to alter inventory strategies.

Future Outlook

- AI and Automation: Advancements in artificial intelligence and automation will revolutionize inventory management.

- Sustainability: Companies are increasingly focusing on sustainable inventory practices to reduce waste.

- Data Analytics: Big data will enhance predictive capabilities, leading to more efficient inventory control.

Conclusion

An increase in business inventories is a multifaceted phenomenon with implications that ripple across various sectors and stakeholders. While it can indicate business confidence and preparedness, it can also reflect underlying economic weaknesses or inefficiencies. By closely monitoring inventory trends, businesses, investors, and policymakers can make informed decisions that promote economic stability and growth. As technology and global markets evolve, the role of inventories will continue to be a vital component in economic analysis and strategic planning.